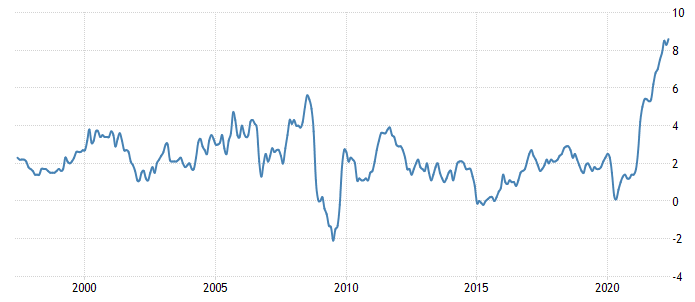

The US Department of Labor (DOL) revealed on June 10 that the country’s inflation rate hit 8.6% in May, the highest level since December 1981, putting pressure on employers to raise salaries to keep up.

Pricing pressures are being caused by an exceptionally tight labor market in the United States, as well as rising gas and food prices.

The consumer price index (CPI) fell to 8.3 percent in April, down from an all-time high of 8.5 percent in March.

Although consumers have gotten accustomed to more moderate yearly price rises of 1.75 percent on average from 2010 to 2019, the long-term average inflation rate in the United States is approximately 3.2 percent.

According to The Kobeissi Letter, an industry commentary on global capital markets, the May CPI measure came in higher than consensus predictions of an unchanged annual rate of 8.3 percent, indicating that “indications of inflation peaking in April were erroneous.”

Mohamed A. El-Erian, Allianz’s senior economic adviser, tweeted: “[The CPI] headline represents a new high for this inflation cycle, adding to the economic/social/political unrest. Furthermore, if the first ten days of June are any indication, the next monthly figure will be higher.”