Central banks all across the world have extensively used the printing press to aid the economy during the health crisis, creating inflation in the process. the well-known “whatever the cost” armed wing. The rise in the overall price level is currently being fought against by these same central banks. And their weapon for it is what they call interest rates.

Inflation in the US fell in July.

The markets anticipated a decrease in July after a month of June that saw 12-month inflation rise to 9.1%. but, to a lesser degree. The markets consequently reacted favorably to the 8.5% inflation announcement since they had been expecting an 8.7% consensus.

The markets finally convert this minor difference into a significant one. either on the equity markets or the marketplaces for cryptocurrencies. But more importantly, it deviates from predictions and actuality. In fact, during the past few months, the real numbers have frequently fallen short of the agreement reached by the various banks and economic specialists.

However, the upcoming release of the August statistics is expected to have an impact on the markets as well. However, we won’t know until Tuesday, September 13. These numbers will make it easy to tell if inflation is on the decline or if it is starting to plateau between 8.5 and 9%.

The markets are likely to exhibit euphoria in the case of a further fall. The markets will be able to react in the upcoming days depending on specific macro factors like the GDP of Great Britain or the industrial production in China for the month of July.

Bitcoin is getting close to $25,000!

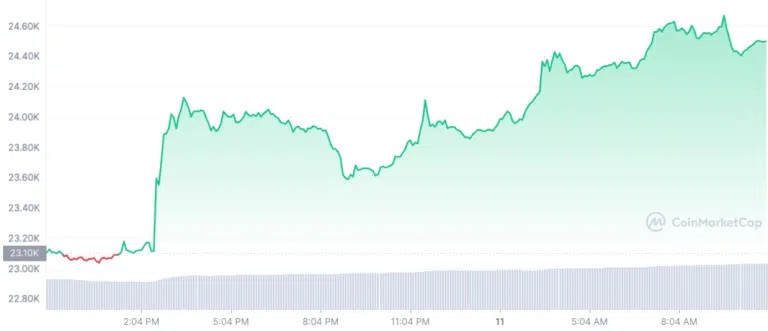

The graph below shows how the price of Bitcoin immediately changed once the inflation rate was set at 8.5%:

The mother of all cryptocurrencies rose from $23 to almost $24,000 in a matter of minutes. A pump that looks to establish the session’s pace today. At the time of writing, the price of one bitcoin is $24,526, which was last reached on July 30. According to many observers, Bitcoin may try to break through the $25,000 barrier level today. Bitcoin would reach its peak point in this scenario in two months.

The altcoins are jubilant as Ethereum draws closer to $2,000!

The price of Ethereum was impacted by the inflation rate announcement as well. The encouraging news coming from the other side of the Atlantic helped Ether to surpass this price level if it had been approaching the 1,800 dollar mark. The surge similarly to Bitcoin set the tempo for today’s session. The price of the five most popular cryptocurrencies and how they have changed over the past day are shown in the following table:

| Crypto | Current course | Evolution over 24 hours |

| Ethereum (ETH) | $1,884.86 | + 11.18% |

| BNB (BNB) | $330.17 | + 3.51% |

| XRP (XRP) | $0.3817 | + 4.60% |

| Cardano (ADA) | $0.5372 | +5.03% |

| Solana (SOL) | $44.44 | + 11.72% |

Ethereum is still the market’s main driver, propelled by the impending arrival of The Merge. The value of the second cryptocurrency is also getting close to Bitcoin’s market cap. And Ethereum has a very strong current market share that is very close to 20%. (19.9). We’ll also mention Solana’s strong performance among the top altcoins, which accounts for roughly 12%. Avalanche (+6.9%) and Polkadot (+8.1%) are also doing well. Unlike BNB and XRP, which on Thursday underperformed the market.

The cryptocurrency market has recently recovered 6.34% for the day. For a global marketcap that, according to data from the Coinmarketcap database, is currently worth $1,150 billion.

The decline in inflation also helps the equity markets!

The decline in inflation in France caused the CAC 40 to recover by almost 6,500 points. On the other side of the Atlantic, the S&P 500 increased by more than 2% yesterday after opening strongly higher. With a gain of 2.85%, the Nasdaq exhibits the same pattern as the S&P 500. The Dow Jones, which is the subject of the same observation, has increased by 1.63%.