Market devastation is caused by panic. Cascaded DeFi protocols. Cryptocurrencies lose an average of 98 percent of their value as the exchanges shut down with a vengeance. That is to say, it is war. In reality, there is a conflict between Russia and Ukraine. What more suitable economic setting? Actually, there is no better setting. Three signs indicating we may have reached a bottom will be shown to us. Consequently, the only direction that remains is up.

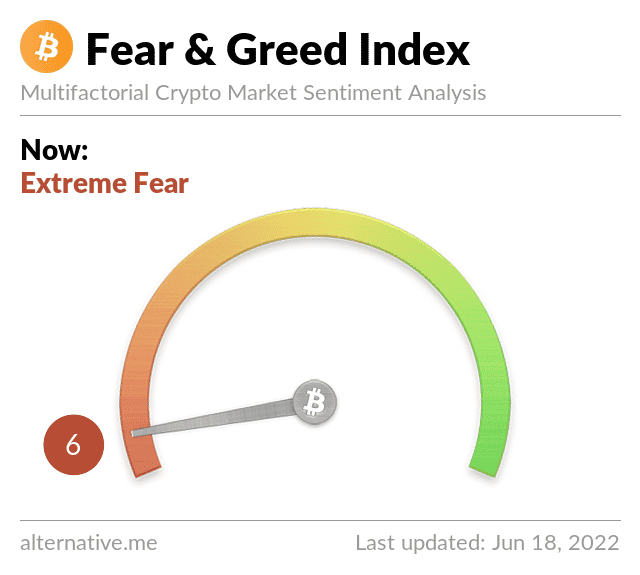

Cryptocurrency panic: Greed and Fear are at 6

Traders and investors study it more than any other indicator. It cannot be used by itself to develop a trading strategy, like any indicators. Instead, it should be used in conjunction with other indications that, when combined, can reveal information about the market’s trajectory. Dread and greed in this context refer to the aspect of fear or greed that rules the market. The only two emotions that influence stock charts are fear and greed. Either out of fear, people sell, or out of greed, people buy. Investors only lose money in 95 percent of cases. This indication reveals something crucial about the fundamentally incorrect sentiment of the majority when it comes to investing.

A fear and greed index of six indicates extreme hopelessness. Everyone believes that the market is a fool’s game, that nobody wins, that it is a hoax, that Warren Buffet was correct, etc. You have to buy when there is blood on the streets, to borrow a famous slogan from this Buffet.

For us, the blood will simply be the crimson of the candles on the stock charts since we are not institutional investors who bet on the collapse of states after civil conflicts. The first indicator that can indicate a purchase signal is this one.

Volatility of Cryptocurrency Exchanges

The volumes on the exchanges are a second sign of investors’ and small traders’ lack of interest in this market. For Arthur Hayes, the former CEO of Bitmex, this is a very intriguing factor. The latter does the following market analysis: How far can we stoop? I believe the answer will be revealed this tragic weekend. From $20,000 and $1,000, respectively, Bitcoin and Ether have significantly recovered this week. Can they delay launching a fresh assault on these levels until the weekend when dirty, new fiat cannot be deposited on cryptocurrency exchanges?

And he is correct. Due to SEPA transfers’ weekend incapability (thanks banks), liquidity cannot enter exchanges during the weekend to make up for the decline. The fall will continue until Tuesday, when the banks awaken, barring a big collapse or a major announcement.

The good news is that it’s now time to take a position because there are no longer any volumes and any buyers or sellers in the market. Once more, it is vital to behave in opposition to the crowd.

How central banks behave

The last thing that terrifies everyone is what central banks are doing. The latter know little to nothing about economics. And the central banks have just realized that it will have an impact on the economy after creating astronomical amounts of money to ensure that it would have no impact on the economy. So, it’s time to panic. The equities market is about to enter a volatile period, while the state of cryptocurrencies is between between an earthquake and a tsunami. This is a chance to extend the decline, look for a new low, and provide traders and investors with an even more compelling entry point. The former CEO of Bitmex makes the following joke to de-dramatize this catastrophic news, which is in fact a harbinger of the bear market: