You may already know this, but one of the unique features of Bitcoin is that there is a cap on the total amount of coins that may be printed. Approximately 19 million bitcoins are now in use. On the other hand, the network won’t be able to circulate more than 21 million BTC over time. What does that actually mean? What will also occur when this limit is reached? In this essay, we will go through everything in detail.

Mining is how fresh bitcoins are made.

Understanding the generation of bitcoins is crucial before talking about the 21 million coin cap.

The process by which a central bank creates money

In the case of fiat currency, a central bank typically controls the production of money. “New money” creation is under the control of central banks.

Additionally, the phrase “turn the printing press” is frequently used in times of crisis, such as during COVID-19. This phrase refers to the central bank’s process, which tends to issue more money in order to infuse liquidity into economies in order to support crisis-affected structures.

How is bitcoin production carried out?

The situation with Bitcoin is totally different. As you are aware, the entire idea behind Bitcoin (and most other cryptocurrencies) is to operate without a middleman, such as a central bank. The network directly controls the creation of money. How ? Using mining…

The process by which the Bitcoin network can produce new currencies is known as mining. This word applies to all cryptocurrencies that operate on the same principles and is not just reserved for Bitcoin. As an illustration, take Dogecoin (DOGE), Litecoin (LTC), etc.

Mining specifically entails verifying a block of transactions. This block is recorded on the blockchain once it has been verified. “Miners” are the persons in charge of mining.

Mining on Bitcoin demands cutting-edge computer hardware. All of the miners in the network are in competition when they mine. Those who successfully validate the block receive compensation for their efforts. To make things clearer, we may contrast the validation of a block with the solution of an equation in mathematics (for the most curious, it is in fact a question of finding the correct hash of the block).

Every four years, a reward is cut in half.

Quantity of bitcoins traded after each block

As mentioned previously, miners receive compensation for their labor. This reward comes in the form of a bitcoin payout. These “new bitcoins” or “mined bitcoins” are distributed to miners and generally placed on the network. Therefore, the process that raises the quantity of BTC coins in circulation is mining.

How much money do miners make specifically? In other words, how many bitcoins are sold on the open market following each block that is mined?

The idea of the halving enters the picture at this point. A halving is an anglicization that refers to the fact that something has been divided in half. As a result, the reward given to miners on Bitcoin is frequently cut in half. The formula for calculating the quantity of bitcoins distributed to miners is as follows:

50/2^n

The integer “n” in this calculation denotes the number of Bitcoin halves that have occurred. This method therefore demonstrated that the prize was… 50 BTC at the beginning of Bitcoin (n=0)! Additionally, mining Bitcoin was highly accessible at the time. That induces a dream? You must keep in mind that at the time, Bitcoin was less than €10.

Every 210,000 blocks, a halving

You should be aware that there is a halving roughly every 210,000 blocks. If you’re not moved by this, realize that it relates to a period of four years.

To explain this, let’s do a little math. A block on Bitcoin is verified every ten minutes or so. According to the breakdown, 210,000 blocks will have actually been authenticated in 4 years:

6 blocks per hour multiplied by 24 hours, 365 days, and 4 years results in 210,240 blocks.

We are currently in the third halving since the invention of Bitcoin. If we apply the above formula, the prize is 6.25 BTC (50/23). As a result, miners are being paid 6.25 BTC for validating a block. In conclusion, 6.25 “new” bitcoins are thereafter released onto the market following each block (every 10 minutes)!

| 1 | November 2012 | 25 | Between €10 and €500 |

| 2 | July 2016 | 12,5 | Between €500 and €20,000 |

| 3 | May 2020 | 6,25 | Between €9,000 and €67,276 (BTC ATH) |

Therefore, the next halving will occur in 2024, bringing the payout for miners down to 3.125 BTC.

The 21 million coin limit and bitcoin

Let’s use the formula above to determine how many bitcoins are released onto the market. The following outcomes emerge when we consider the long term:

| Halving number (n) | Reward (BTC) |

| 32 | 0.0000000116 BTC or 1.16 satoshis |

| 33 | 0.0000000058 BTC or 0.58 satoshis |

Remember that the Satoshi, which is equal to 0.00000001 BTC, is the smallest unit of Bitcoin that can exist. There is no smaller coin than the Satoshi; to put it another way, it is similar to your €0.01 coin.

In other words, number 32 will be the final halving since starting with number 33, the amount of bitcoins paid will be less than the Satoshi.

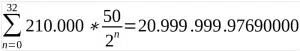

How many bitcoins will be in use at that point (the 32nd halving)? To accomplish this, adhere to the next mathematical formula:

The elements of this formula are as follows:

The halving name is n.

The number of blocks between two halvings is 210,000

50: the first payment (in Bitcoin) given for every valid block

If you are not familiar with mathematical formulas, the main point is to realize that it is possible to figure out how many bitcoins are currently in circulation. But according to this math, there will be 20,999,999.976,900 bitcoins in circulation at the 32nd halving.

The limit of 21 million bitcoins is thus understood to be theoretical and to correspond to an asymptote thanks to this formula. As a result, there will never be exactly 21 million bitcoins, but there will be close to that number. Therefore, we should talk about 21 million bitcoins to the nearest Satoshi if we want to be precise.

What happens after the 21 million BTC?

It is simple to determine that the 32nd halving will occur in 2140 using the facts already discussed. In other words, all of the coins will have been produced by the Bitcoin network by the year 2140. But what will occur after that?

There won’t be any “new” bitcoins available on the market at that point. This won’t have an effect on the transaction procedure, though. The normal flow of transactions will continue, and blocks of transactions will be collected. Simply said, miners won’t get “new” bitcoin incentives anymore. They will always be paid in BTC but with bitcoins that are already in circulation thanks to transaction fees. Additionally, the Bitcoin network will have advanced by then, and miners may find new ways to make money. Making mining, which is crucial for the Bitcoin network’s functionality, attractive will remain a struggle.